With each state, and with each utility company, the layout of your commercial energy bill is unique. They each have the same level of transparency, displaying your associated energy costs for both generation and delivery, but they may be presented*. Most people don’t have the time of day or desire to decipher what each cost on their bill is—most just check the amount due, the date on which its due, and then pay it, not thinking about it again until the next bill arrives.

But if your energy costs are high, or you don’t recognize what a particular charge is, it may be time to take a closer look at your bill and understand where your hard-earned money is going.

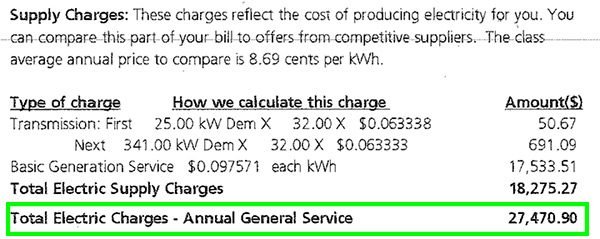

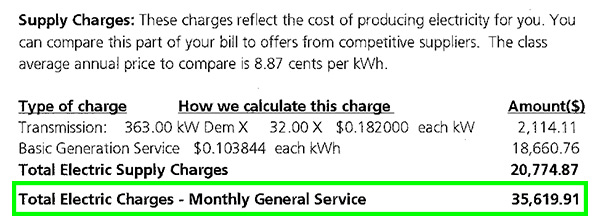

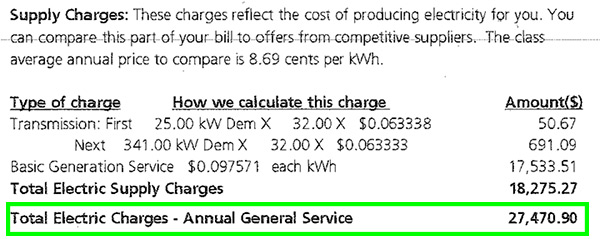

For example, some utilities offer larger customers a choice in rate tariffs such as time-of-use rates versus more of a flat rate. This topic is paramount but beyond the scope of this blog and there are many experts in our industry who can offer guidance. But as a quick reference point, and to really drive home the importance of researching and understanding what makes up your bill, here is a cost differential for a NJ-based business between a monthly tariff and an annual tariff:

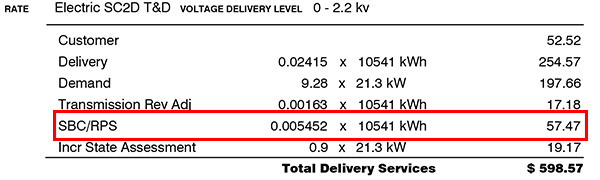

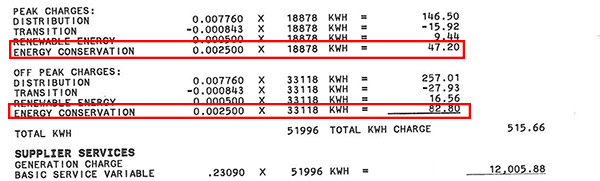

Of particular importance to energy efficiency, though, is the one item you’re being charged for, that you may not even notice, that pays into efficiency programs and can be money put right back into your business: The EE-related charge. On an Eversource bill, for example, it’s referred to as an “Energy Conservation” charge. On a NY State Electric & Gas bill, it’s called an “SBC/RPS” charge. National Grid also labels it as an “SBC/RPS” cost. Pacific Gas and Electric in California lists it as a “State Energy Resource Tax”.

NJ has an RGGI charge and a Societal Benefits Charge. Be sure to check your utility’s website for the program they offer. Each utility website will describe the purpose and goals of their energy efficiency programs like such:

“The RGGI States are channeling a majority of their RGGI proceed investments to energy efficiency programs, including programs to weatherize homes, to provide rebates for energy-efficient appliances, and to provide grants for large-scale efficiency projects in commercial and industrial facilities.

But regardless of the verbiage, the purpose is the same: to collect an amount of money that every business must pay in to the state utility’s energy efficiency program.

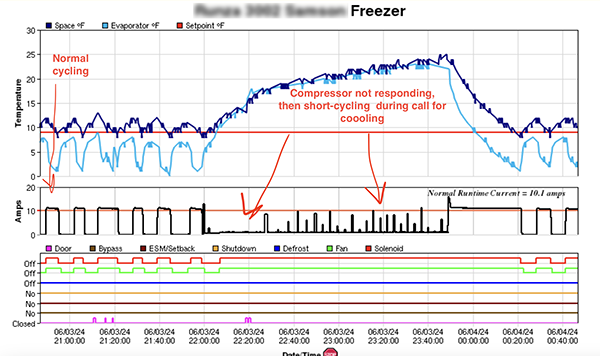

Your state’s energy efficiency program is a fund that has the utilities help pay for measures that reduce your business’ energy usage. This can be anything from adding economizers to your HVAC components, replacing all of your building’s fluorescent light bulbs with more-efficient LEDs, and to retrofitting your commercial or industrial refrigeration systems with high efficiency motors or smart controls to optimize performance efficiency. In some instances, we’ve seen the state utility company cover up to 70% of an efficiency project’s cost.

“As Robert Mittelstaedt, dean emeritus of the W. P. Carey School of Business at Arizona State University, says, ‘Electric utilities find themselves in an awkward position where they make money by selling power, but are required by regulators, and increasingly by consumers, to help customers find ways to save power or use renewable sources. The collision of new technology, social good, business strategy and politics will make the next decade the most interesting in the century-long history of the industry.’1“

We know what you may be thinking: how is it beneficial to the utility company for your business to use LESS energy and therefore pay them less every month?

“’The utility has to present programs before the public utility commission and say, ‘This is how we’re going to promote energy efficiency,’” says Todd Recknagel, CEO of the Charleston, S.C.-based AM Conservation Group, a company that specializes in creating customized energy and water conservation programs for utilities throughout the nation. ‘Like anything else, it’s driven by the money. It’s a win-win-win situation all the way around. If they do hit their goals and targets and do well, the public utility commission will allow them a rate hike.’1“

On the surface, this may appear worrisome but in nearly all cases, the incremental rate hike doesn’t compare to the amount of savings for your business. If upgrading your building’s lighting to LEDs and retrofitting your refrigeration with controls saves you 30% on your bill, but results in a 3% rate increase, you’re still much better off than you were before. If you currently have to pay into this mandated program, why wouldn’t you in turn try to take advantage of it?

The funds used for improving end-use efficiency also have the benefit of avoiding the building of new power plants, so you can consider all the efficiency projects to be a sort of micro utility in that it gives back capacity to the grid.

What the efficiency program offers, in terms of measures and incentives or rebates, will vary by state and utility, much like the presentation of your bill. It’s important that you contact your specific provider or visit their website and research what would be included in a project. Everything from retail to education to municipalities can all benefit from taking advantage of these measures and it’s crucial that knowledge about them gets out there.

*One caveat is if the customer lives in a deregulated state and they have chosen a 3rd Party for generation, they may get a separate bill for this charge.

One thing that is true across all market segments and utilities is that the amount you pay on your bill towards these energy efficiency programs is based on the amount of energy you consume: consume less, pay less; consume more, pay more. The easiest way to consume less is to make your facility as energy efficiency as possible. There are numerous contractors such as NRM who can provide a turnkey solution (perform the audit, get the incentives and perform the installation) and make the process easy and cost effective for you.